What is Withholding Tax?

Withholding tax, also known as retention tax or source tax, is a taxation system where a payer deducts a certain amount of tax from the payments it makes to a payee and remits that amount directly to the government on behalf of the payee. This form of taxation is often applied to income such as wages, dividends, interest, and other payments. The purpose of withholding tax is to ensure the prepayment of taxes, promote tax compliance, and facilitate efficient tax collection by taxing authorities. The amount withheld is usually a percentage of the total payment and is credited against the recipient's final tax liability. Withholding tax is prevalent in various countries as a means of collecting income taxes at the source.

How to configure Withholding Tax Configuration in SAP S/4 HANA ?

STEP 1: Check Withholding Tax Countries/Regions

Withholding Tax Countries/Regions" refers to those jurisdictions or geographical areas where the concept of withholding tax is implemented as part of the tax system. In these countries or regions, tax regulations require the payer of certain types of income, such as salaries, interest, dividends, or payments to non-residents, to withhold a specified percentage of the amount and remit it to the government as a prepayment of the recipient's income tax liability. Withholding tax countries/regions use this mechanism to ensure the efficient collection of taxes and compliance with tax laws on various forms of income.

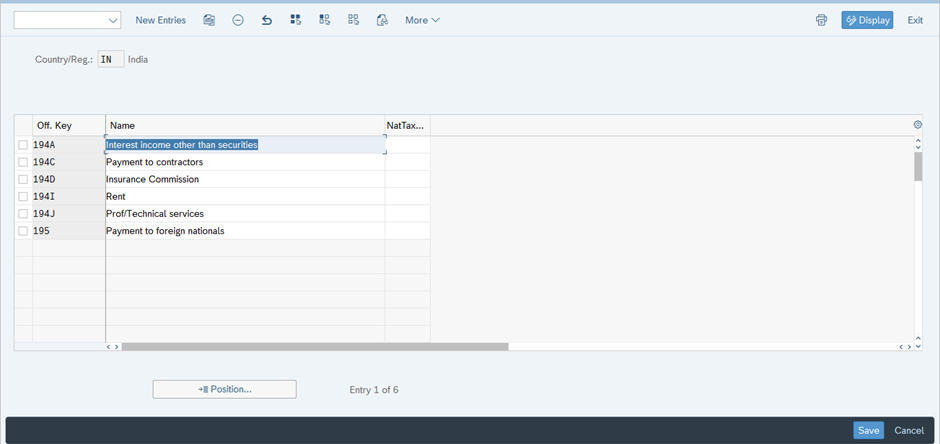

STEP 2: Define Withholding Tax Keys

Withholding Tax Key is a unique identifier assigned to different tax types or rates within the withholding tax functionality. It serves as a link between specific tax types and the corresponding tax codes. Withholding Tax Keys play a crucial role in configuring and managing withholding tax processes for different countries or regions. They help define how much tax should be deducted at the source and contribute to accurate and compliant financial transactions within the SAP system.

Enter Country Region Key IN

STEP 3: Define Withholding Tax Type for Invoice Posting

Withholding Tax Type for Invoice Posting" refers to a specific tax type associated with the deduction of taxes at the time of posting an invoice. It indicates the category or type of withholding tax applicable to the transaction. This feature ensures that the correct amount of tax is withheld and reported to tax authorities during the invoice posting process in compliance with tax regulations.

Withhold tax type (C5) Rent invoice

STEP 4: Define Withholding Tax Type for Payment Posting

Here the withholding tax type is assigned for the payment purpose and the same will not get triggered at the time of Invoice Posting. The withholding information is to be provided while posting for such document for Withholding Tax payment.

For each Withholding Tax Type, according to the different rates available in the Income tax rates, the different Withholding Tax Codes are to be created based on the Withholding Tax Type.

STEP 5: Check Recipient Types

For each withholding tax type, create two entries as follows:

Recipient Type: CO- Companies, OT- Others

Country Version India comes with sample settings for the sample withholding tax types provided.

Master Data- Enter the recipient type in each vendor master and each customer master.

Reporting- The TDS returns separate the information about taxes withheld on legal persons and on natural persons.

Enter Country Region Key

C5 For Invoice and C6 Payment

STEP 6: Define Withholding Tax Codes

Withholding Tax Codes are unique identifiers assigned to specific types of withholding taxes. These codes are linked to various tax rates and regulations for different tax authorities. When processing financial transactions involving payments subject to withholding tax, these codes help determine the appropriate tax deduction based on the relevant tax laws and rates.

Enter Country Region Key

Click on New Entry

Click on New Entry For Rent Payment

STEP 7: Assign Withholding Tax Types to Company Codes

Assigning withholding tax types to company codes in SAP involves linking specific types of withholding taxes to individual company codes within the system. This configuration ensures that the correct withholding tax rules and rates are applied based on the company's location and legal requirements. By defining these associations, SAP can accurately calculate and process withholding tax obligations during financial transactions for each company code.

New Entry

C6 For Payment, Recipient Type co company

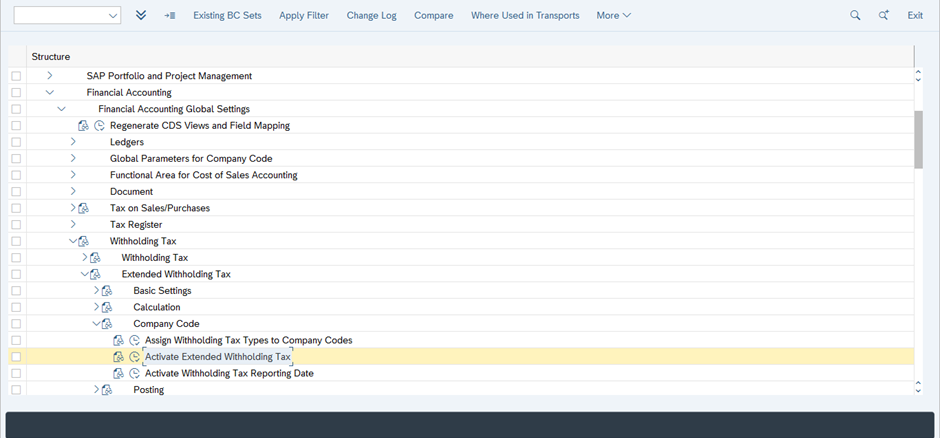

STEP 8: Activate Extended Withholding Tax

This activation involves configuring the system to support more complex withholding tax scenarios, such as multiple tax codes and rates, exemptions, and specific business rules. By activating extended withholding tax, organizations can meet the requirements of diverse tax regulations and ensure accurate withholding tax calculations and reporting in SAP systems.

STEP 9: Create GLS For TDS

Open Item Management Select Field Status G001 and Save

STEP 10: Define Accounts for Withholding Tax to be Paid Over (OBWW)

Enter Your Chart Of Account

Click on New Entry

Withholding Tax Type C5 C6, Withholding Tax Code C5 C6 and both assign single one GL (TDS Payable)

STEP 12: Determine the year for TDS certificate number range

Path:- SPRO , IMG, Logistic general, Tax on good movement, India, Basic setting, Maintain co code Setting.

How Withhold Tax Works in SAP S/4 HANA?

STEP 11: Maintain withholding tax types and Vendor Pan no in BP

Maintain Vendor Pan Number

Change BP Role:-FLVN00

Click on Vendor country-spec. Enh. Tab And Enter Vendor Pan Number

Maintain withholding tax types

Click on Company Code

Click On Vendor Withholding Tax Tab> Add - W/H Tax Type, W/H Tax Code, Recipient Type .

STEP 13: Vendor Invoice ( T.Code FB60)

Click on Withholding Tax Tab and Post.

Document Display

Thank you for taking the time to read my blog.

Upcoming SAP S4 HANA live Batches:

SAP Financial Accounting (FICO)

Course link: https://www.gauravconsulting.com/product-page/sap-s-4-hana-finance-beginners-live-training

SAP Sales & Distribution (SD)

Course link: https://www.gauravconsulting.com/product-page/sap-s4-hana-sales-distribution-sd-live-training

SAP Extended Warehouse Management (EWM)

"I’m so grateful for the support I received with my assignment taxation. The experts provided clear explanations and well-structured solutions, making a challenging topic much easier to understand. Their timely help not only improved my assignment quality but also boosted my confidence in the subject. Thank you for such a reliable and professional service!"

EPTU Machine ETPU Moulding…

EPTU Machine ETPU Moulding…

EPTU Machine ETPU Moulding…

EPTU Machine ETPU Moulding…

EPTU Machine ETPU Moulding…

EPS Machine EPS Block…

EPS Machine EPS Block…

EPS Machine EPS Block…

AEON MINING AEON MINING

AEON MINING AEON MINING

KSD Miner KSD Miner

KSD Miner KSD Miner

BCH Miner BCH Miner

BCH Miner BCH Miner